Embark on a journey to uncover the secrets of comparing life insurance quotes without hidden fees. This guide will walk you through the intricacies of finding the right policy for you.

Understand the Basics of Life Insurance

Life insurance is a financial product designed to provide a lump sum payment to beneficiaries in the event of the policyholder’s death. The main purpose of life insurance is to offer financial protection and security to loved ones after the policyholder passes away.

By paying regular premiums, you ensure that your family members are taken care of financially in your absence.

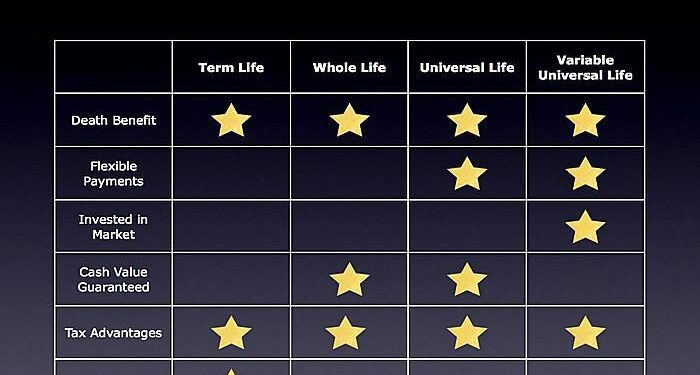

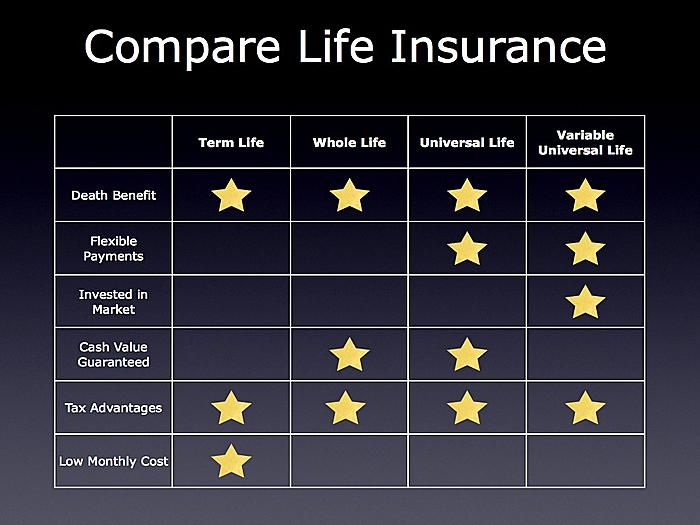

Types of Life Insurance

- Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years. It is generally more affordable but does not have a cash value.

- Whole Life Insurance: Offers coverage for the entire life of the policyholder and includes a cash value component that grows over time. Premiums are typically higher compared to term life insurance.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest. Policyholders have flexibility in adjusting premiums and death benefits.

- Variable Life Insurance: Allows policyholders to allocate premiums to investment options like stocks and bonds. The cash value and death benefit depend on the performance of these investments.

Importance of Comparing Quotes

- Cost Comparison: Different insurance providers offer varying rates for the same coverage, so comparing quotes helps you find the most affordable option.

- Coverage Options: By comparing quotes, you can assess the different coverage options available and choose a policy that best suits your needs and budget.

- Policy Features: Each life insurance policy comes with its own set of features and benefits. By comparing quotes, you can identify which policy offers the most comprehensive coverage.

Factors to Consider When Comparing Quotes

When comparing life insurance quotes, there are several key factors to consider that can impact the cost and coverage of the policy. Understanding these factors is crucial in making an informed decision about which policy best suits your needs.

Coverage Amount

- The coverage amount refers to the total sum of money that will be paid out to your beneficiaries upon your death.

- A higher coverage amount typically results in higher premiums, but it ensures that your loved ones are adequately protected financially.

- It’s important to assess your financial obligations and the needs of your dependents when determining the appropriate coverage amount.

Term Length

- The term length of a life insurance policy dictates how long the coverage will last.

- Shorter terms usually have lower premiums, but they may not provide coverage for as long as you need.

- Consider factors like your age, financial goals, and dependents’ needs when choosing the term length of your policy.

Riders

- Riders are additional benefits that you can add to your policy for an extra cost.

- Common riders include accelerated death benefit, waiver of premium, and accidental death benefit.

- Adding riders can enhance your coverage but will also increase the overall cost of the policy.

Personal Factors

- Personal factors such as age, health, and lifestyle play a significant role in determining life insurance quotes.

- Younger individuals and those in good health typically receive lower premiums.

- Health conditions, smoking habits, and risky activities can lead to higher premiums or even denial of coverage.

How to Identify Hidden Fees in Life Insurance Quotes

When comparing life insurance quotes, it’s crucial to be aware of hidden fees that may not be immediately obvious. These fees can significantly impact the overall cost of your policy, so it’s essential to know how to spot them.Some tips to identify hidden fees in life insurance quotes include:

Common Hidden Fees in Life Insurance Quotes

- Policy Fee: This is a flat fee charged by the insurance company for administrative costs. It is typically not included in the premium amount but can add to the overall expense of the policy.

- Surrender Charges: These fees are incurred if you cancel your policy early or surrender it for cash value. They can vary depending on the policy and may not be clearly stated in the initial quote.

- Underwriting Fees: These fees cover the cost of evaluating your application and determining your risk profile. They are often hidden in the fine print of the policy documents.

It’s important to carefully review the policy details and ask your insurance agent about any fees that may not be explicitly mentioned in the quote.

Tips for Transparent Comparison Shopping

When comparing life insurance quotes from different insurers, it’s essential to look beyond just the premium amount. Here are some strategies to ensure transparency in the quoting process and uncover any hidden fees:

Read the Fine Print Carefully

Before committing to a life insurance policy, make sure to read the policy documents thoroughly. Pay close attention to any fine print or clauses that may indicate hidden fees or exclusions. Understanding the terms and conditions will help you make an informed decision and avoid any surprises down the line.

Compare More Than Just the Premium

While the premium amount is an important factor, it’s not the only thing to consider when comparing life insurance quotes. Look at the coverage amount, policy features, and any additional benefits offered by each insurer. By evaluating the overall value of the policy, you can ensure you’re getting the best deal for your money.

Ask Questions and Seek Clarification

If you come across any terms or fees that you don’t understand, don’t hesitate to reach out to the insurance provider for clarification. Asking questions can help you uncover any hidden costs and ensure that you have a clear understanding of what you’re signing up for.

Transparency is key in the insurance industry, so don’t be afraid to seek answers.

Last Point

In conclusion, navigating the world of life insurance quotes can be daunting, but with the right knowledge, you can make informed decisions to secure your future.

Top FAQs

How can I identify hidden fees in life insurance quotes?

Look out for charges like policy fees, administrative fees, and premium loadings that may not be explicitly stated in the quote.

What factors should I consider when comparing life insurance quotes?

Consider coverage amount, term length, riders, and how personal factors like age and health can impact the cost and coverage.

Why is it important to read the fine print when comparing quotes?

Reading the fine print helps uncover any hidden fees or clauses that may impact the overall cost and coverage of the policy.