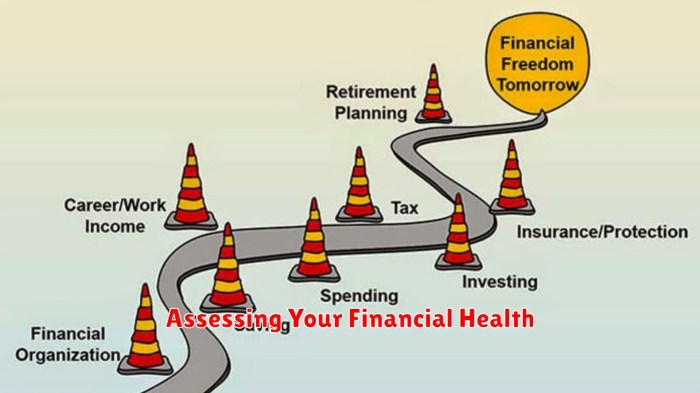

Combining Financial Planning with Health Routines sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. This unique integration of financial strategies with health habits promises to revolutionize the way we approach overall wellness.

Benefits of Combining Financial Planning with Health Routines

Financial stability plays a crucial role in overall health and well-being. When individuals have their finances in order, they experience reduced stress and anxiety, which can have positive effects on their physical and mental health. Aligning financial planning with health routines can lead to a more balanced and fulfilling lifestyle.

Impact of Financial Stability on Health

Financial stability allows individuals to access better healthcare options, afford nutritious food, and participate in physical activities that promote overall well-being. The peace of mind that comes with having financial security can reduce the risk of developing stress-related health issues such as high blood pressure, heart disease, and depression.

Advantages of Aligning Financial Goals with Health Objectives

By setting financial goals that prioritize health, individuals can allocate resources towards preventive healthcare measures, gym memberships, healthy meal plans, and mental wellness activities. This alignment ensures that financial decisions support a healthy lifestyle, leading to long-term benefits in terms of physical fitness, mental clarity, and overall quality of life.

Examples of How Financial Planning Supports a Healthy Lifestyle

- Creating a budget that includes funds for gym memberships, fitness classes, or sports equipment encourages regular physical activity.

- Setting aside savings for routine medical check-ups and preventive screenings promotes early detection of health issues.

- Investing in healthy food options and meal prep services supports a balanced diet and reduces the temptation to rely on fast food or unhealthy snacks.

- Building an emergency fund can provide a safety net for unexpected health expenses, reducing financial stress during challenging times.

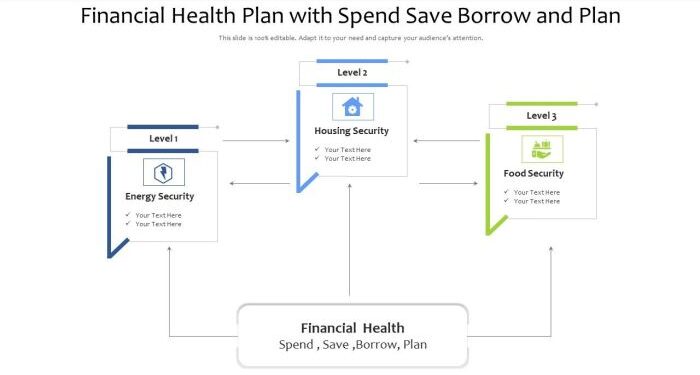

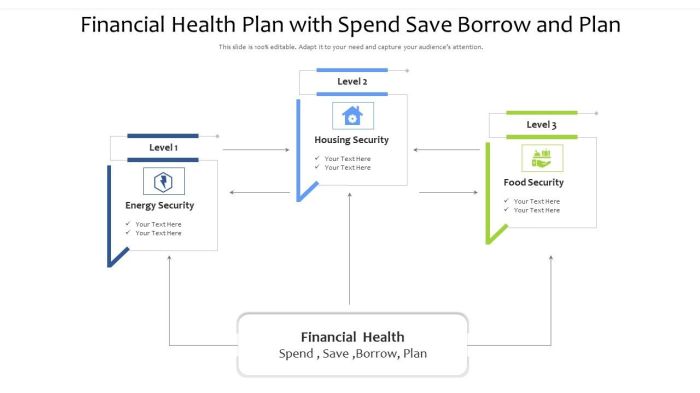

Strategies for Integrating Financial Planning and Health Routines

Integrating financial planning with health routines involves creating a comprehensive approach that prioritizes both physical well-being and financial stability. By incorporating health-related expenses into your budget, setting financial goals that align with your wellness priorities, and ensuring you have adequate insurance coverage and emergency funds, you can effectively support your health goals while maintaining financial security.

Create a Budget that Includes Health-Related Expenses

- Identify recurring health expenses such as gym memberships, nutritious food, and preventive care.

- Allocate a specific portion of your budget towards health-related costs to ensure they are adequately covered.

- Consider setting up a separate savings account for medical emergencies or unexpected health expenses.

Set Financial Goals that Prioritize Health and Wellness

- Establish clear objectives for both your financial and health goals to maintain focus and motivation.

- Include milestones related to improving your health, such as losing weight, quitting smoking, or managing stress.

- Monitor your progress regularly and adjust your goals as needed to stay on track.

Importance of Insurance and Emergency Funds in Supporting Health Goals

- Ensure you have adequate health insurance coverage to protect yourself from high medical costs.

- Consider investing in disability insurance to safeguard your income in case of illness or injury.

- Build an emergency fund to cover unexpected health-related expenses or any gaps in insurance coverage.

Impact of Stress on Financial Planning and Health

Stress can have a significant impact on both financial planning and overall health. When individuals are under stress, they may make impulsive financial decisions, such as overspending or neglecting to save for the future. This can lead to financial instability and long-term consequences on financial well-being.

Moreover, stress can also manifest physically, affecting health outcomes such as increased blood pressure, weakened immune system, and mental health issues.

Effects on Financial Decisions

Stress can cloud judgment and impair decision-making abilities, leading individuals to make choices that may not align with their long-term financial goals. This can result in accumulating debt, neglecting savings, or even engaging in risky investments. The financial repercussions of stress-induced decisions can have lasting effects on one’s financial stability and future prospects.

Effects on Health

The impact of stress on health should not be underestimated. Chronic stress can contribute to various health issues, including heart disease, obesity, and mental health disorders. Furthermore, the physical symptoms of stress can impede daily functioning and decrease overall quality of life.

It is crucial to address stress management not only for financial well-being but also for maintaining good health.

Coping Mechanisms for Managing Stress

To mitigate the negative effects of stress on both financial planning and health, individuals can incorporate stress management techniques into their daily routines. This may include practices such as mindfulness meditation, exercise, adequate sleep, and seeking professional help when needed.

By prioritizing stress management, individuals can improve their decision-making abilities, enhance their overall well-being, and maintain a more balanced approach to financial planning.

Link Between Stress, Productivity, and Financial Well-being

Stress has a direct impact on productivity levels, which can ultimately influence financial well-being. High levels of stress can lead to decreased focus, motivation, and efficiency in completing tasks, whether related to work or financial planning. By managing stress effectively, individuals can boost their productivity, make better financial decisions, and ultimately improve their financial outcomes and overall quality of life.

Healthy Habits for Financial Success

Maintaining healthy lifestyle habits not only benefits your physical well-being but can also positively impact your financial stability. By incorporating healthy routines into your daily life, you can improve your overall productivity, reduce healthcare costs, and increase your focus on financial goals.

Recommendations for Balancing Work, Health Routines, and Financial Responsibilities

- Set realistic goals: Establish achievable targets for both your health and financial well-being to maintain a balanced approach.

- Prioritize self-care: Make time for exercise, adequate sleep, and healthy eating habits to ensure your overall well-being.

- Create a schedule: Plan your day effectively to allocate time for work, exercise, meal preparation, and financial tasks.

- Seek professional advice: Consult with a financial advisor and healthcare provider to receive guidance on managing both aspects of your life.

Role of Discipline and Consistency in Achieving Financial Goals while Maintaining Health

Consistency is key to success in both financial planning and health routines. By staying disciplined and following a structured approach, you can develop habits that lead to long-term financial stability and improved well-being.

- Track your progress: Monitor your financial goals and health milestones regularly to stay motivated and on track.

- Practice self-discipline: Avoid impulsive spending and unhealthy habits by staying true to your long-term objectives.

- Celebrate small victories: Recognize and reward yourself for achieving milestones in both your financial and health journeys to maintain motivation.

- Stay adaptable: Be open to adjusting your financial and health strategies as needed to accommodate changes in your circumstances and goals.

Tools and Resources for Integrating Financial and Health Planning

When it comes to combining financial planning with health routines, utilizing the right tools and resources can make a significant difference in achieving your goals efficiently.

Apps and Platforms for Tracking Financial and Health Data

- One popular app that allows you to track both financial and health-related data is Mint. Mint helps you create budgets, track expenses, and monitor your financial goals, while also allowing you to input and track your health-related expenses and activities.

- Another useful platform is MyFitnessPal, which not only helps you track your daily food intake and exercise but also includes features to monitor your healthcare costs and insurance claims.

Benefits of Consulting Professionals for Financial and Health Advice

- Consulting financial advisors and health professionals can provide you with personalized guidance tailored to your specific needs and goals.

- Financial advisors can help you create a comprehensive financial plan that aligns with your health goals, while health professionals can offer advice on how your lifestyle choices impact your financial well-being.

Streamlining Management with Technology

- Technology plays a crucial role in integrating financial planning and health routines by offering automation and synchronization features.

- Apps like Fitbit can sync with financial apps to provide a holistic view of your well-being, including your physical activities and financial transactions.

End of Discussion

In conclusion, the fusion of financial planning and health routines opens up a world of possibilities for individuals seeking a balanced and fulfilling life. By harmonizing these two crucial aspects, one can pave the way for a future defined by prosperity and vitality.

Query Resolution

How does financial stability impact overall health?

Financial stability can reduce stress levels, improve mental well-being, and provide resources for healthier lifestyle choices.

What are some tips for creating a budget that includes health-related expenses?

Allocate a specific portion of your budget for health needs, prioritize essential health expenses, and explore ways to save on healthcare costs.

Why is insurance important in supporting health goals?

Insurance provides a safety net for unexpected medical expenses and ensures access to quality healthcare services without financial burden.

What are some healthy habits that contribute to financial success?

Regular exercise, proper nutrition, adequate sleep, and stress management can all contribute to better financial decision-making and overall well-being.

Can technology help streamline the process of managing finances and health routines simultaneously?

Yes, there are various apps and platforms available that can help track both financial and health-related data, making it easier to monitor progress and stay on top of goals.