Delving into the realm of “All-in-One Liability Insurance for Small Business Operations,” this initial passage entices readers with a blend of knowledge and insight, promising a comprehensive and unique exploration of the subject.

The following paragraph will shed light on the intricacies and importance of this type of insurance for small businesses.

Overview of All-in-One Liability Insurance for Small Business Operations

All-in-one liability insurance is a comprehensive policy that combines different types of liability coverage into a single plan, tailored specifically for small businesses. This type of insurance is crucial for small businesses as it provides protection against a variety of risks and potential financial losses.Having a single insurance policy that covers multiple liabilities simplifies the insurance process for small business owners.

Instead of managing several separate policies, they can have peace of mind knowing that all their liabilities are covered under one umbrella policy.

Common Liabilities Covered Under an All-in-One Policy

- General Liability: Protection against third-party claims of bodily injury, property damage, or advertising injury.

- Professional Liability: Coverage for errors, omissions, or negligence in professional services provided.

- Product Liability: Protection in case a product causes harm or injury to a customer.

- Cyber Liability: Coverage for data breaches, cyber-attacks, and other online risks.

- Property Damage: Protection for damage to physical assets like buildings, equipment, or inventory.

Types of Liabilities Covered

When it comes to all-in-one liability insurance for small business operations, there are several types of liabilities that are typically covered to provide comprehensive protection. These coverages are essential for safeguarding businesses against various risks and potential financial losses.

General Liability

General liability insurance typically covers claims related to bodily injury, property damage, and advertising injury. For small businesses, this type of coverage is crucial in case a customer slips and falls on the premises or if there is damage caused to a client’s property during service.

For example, a customer visiting a small bakery could slip on a wet floor and sustain injuries, leading to a potential lawsuit. General liability insurance would help cover legal fees and medical expenses in such a scenario.

Professional Liability

Professional liability insurance, also known as errors and omissions insurance, protects businesses against claims of negligence or inadequate work. Small businesses providing professional services, such as consultants, accountants, or IT professionals, could benefit from this coverage. For instance, if a small accounting firm makes an error in a client’s tax return, resulting in financial losses for the client, professional liability insurance would help cover legal defense costs and settlements.

Product Liability

Product liability insurance covers businesses that manufacture, distribute, or sell products in case a product causes harm or injury to a consumer. For small businesses selling physical goods, this coverage is essential. In a scenario where a small toy company sells a defective toy that injures a child, product liability insurance would assist in covering legal expenses and potential settlements.

Cyber Liability

Cyber liability insurance protects businesses from expenses related to data breaches, hacking incidents, or cyberattacks. In today’s digital age, small businesses are increasingly vulnerable to cyber threats. For example, if a small online retailer experiences a data breach resulting in customer information being compromised, cyber liability insurance would cover costs associated with notifying affected customers and managing the breach.

Comparison to Standalone Liability Insurances

An all-in-one liability insurance policy combines various types of coverages into a single, comprehensive package, offering convenience and potentially cost savings compared to purchasing standalone liability insurances separately. With standalone policies, a small business may need to manage multiple premiums, policies, and renewals, whereas an all-in-one policy streamlines the process and provides broader protection against different types of liabilities.

Customization and Tailoring of Policies

When it comes to small businesses, having the ability to customize and tailor their all-in-one liability insurance policies is crucial. This allows them to ensure that they are adequately protected against specific risks that are unique to their industry or operations.

Process of Tailoring Coverage

- Small businesses can adjust coverage limits to match the size and scope of their operations. This ensures that they are not overpaying for coverage they do not need or underinsured for potential risks.

- Deductibles can be modified to fit the financial capabilities of the business. By choosing a deductible that aligns with their budget, small businesses can effectively manage their out-of-pocket expenses in the event of a claim.

- Additional protections, such as adding endorsements or riders to the policy, can provide extra coverage for specific liabilities that are not included in the standard policy. This tailored approach helps small businesses address their unique risks effectively.

Examples of Industries Benefiting from Tailored Policies

- A construction company may opt for higher coverage limits for liability related to property damage or bodily injury due to the nature of their work.

- A technology startup may choose to add cyber liability coverage to protect against data breaches and cyber-attacks, which are common risks in their industry.

- A professional services firm, such as a consultancy or accounting firm, may customize their policy to include errors and omissions insurance to protect against claims of professional negligence.

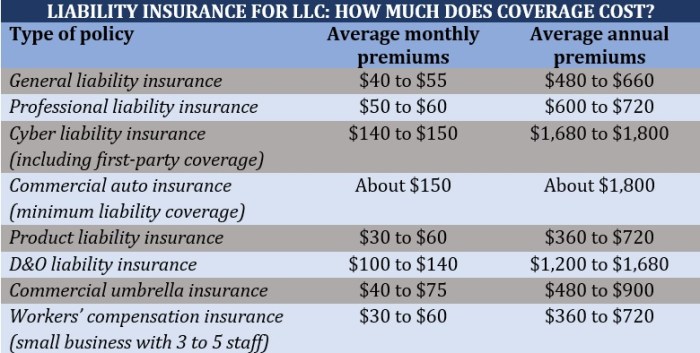

Premium Costs and Factors Influencing Pricing

When it comes to all-in-one liability insurance for small businesses, the premium costs are influenced by various factors. These factors can impact how much a business pays for coverage and it’s important for small business owners to understand what influences these costs.

Factors Influencing Premium Costs

- Business Size: The size of a business, including its annual revenue and number of employees, can impact insurance premiums. Larger businesses with more assets and employees may face higher premiums.

- Industry Type: The type of industry a business operates in can also affect premium costs. Industries with higher risks of liability, such as construction or healthcare, may have higher premiums.

- Coverage Limits: The coverage limits chosen by a business will directly impact premium costs. Higher coverage limits mean more protection but also higher premiums.

- Risk Factors: The specific risks associated with a business, such as previous claims history, location, and safety protocols, can influence premium costs. Higher risk factors may lead to higher premiums.

Tips for Managing Insurance Premiums

- Shop Around: Compare quotes from different insurance providers to find the best rates for your business.

- Bundle Policies: Consider bundling multiple types of insurance coverage, such as liability and property insurance, to potentially save on premiums.

- Implement Risk Management Practices: Improve safety measures, conduct regular risk assessments, and address any potential liabilities to reduce risk factors and potentially lower premiums.

- Review and Update Policies: Regularly review your insurance policies to ensure they still meet the needs of your business. Update coverage limits or make changes as needed to avoid overpaying for coverage you don’t need.

Claims Process and Support

When it comes to filing a claim under an all-in-one liability insurance policy, there are specific steps that need to be followed. Understanding this process is crucial for small businesses to ensure a smooth and efficient claims experience.

Steps Involved in Filing a Claim

- Notify your insurance provider as soon as the incident occurs. Prompt reporting is essential to initiate the claims process.

- Fill out the necessary claim forms provided by the insurance company. Provide accurate and detailed information about the incident.

- Gather and submit any relevant documentation to support your claim, such as photos, witness statements, or police reports.

- Cooperate with the insurance adjuster assigned to your claim. They may conduct an investigation to assess the validity of the claim.

- Receive a decision from the insurance company regarding the coverage and settlement of your claim. If approved, you will receive compensation according to the terms of your policy.

Support and Assistance from the Insurance Provider

During the claims process, small businesses can expect support and assistance from their insurance provider. This can include:

- Guidance on completing claim forms and providing necessary documentation.

- Regular updates on the status of your claim and any additional information required.

- Access to a claims adjuster who can answer your questions and address any concerns you may have.

- Assistance in negotiating settlements and ensuring that you receive fair compensation for covered losses.

Best Practices for Documenting Incidents and Communicating with the Insurance Company

- Document the incident immediately by taking photos, gathering witness contact information, and making detailed notes.

- Report the incident to the authorities if necessary, such as in cases of theft, vandalism, or accidents involving injuries.

- Notify your insurance provider as soon as possible to initiate the claims process.

- Be honest and accurate in your communication with the insurance company to avoid any delays or complications in the claims process.

- Keep all communication with the insurance company in writing and maintain copies of all correspondence for your records.

Wrap-Up

Concluding our discussion on a high note, this final paragraph encapsulates the key points and leaves readers with a memorable takeaway from our exploration of all-in-one liability insurance for small business operations.

Helpful Answers

What is the advantage of having all-in-one liability insurance?

Having all-in-one liability insurance streamlines coverage for small businesses by consolidating multiple liabilities under a single policy, offering convenience and comprehensive protection.

Can small businesses customize their all-in-one liability insurance?

Yes, small businesses can tailor their policies to meet specific needs by adjusting coverage limits, deductibles, and additional protections to align with their unique requirements.

How do factors like business size and industry type influence premium costs?

Factors such as business size, industry type, coverage limits, and risk factors play a role in determining premium costs for all-in-one liability insurance, with larger businesses and riskier industries often facing higher premiums.