Exploring the world of Top Business Insurance Bundles for Small Firms opens up a realm of possibilities for small businesses looking to protect themselves. From cost-saving benefits to tailored coverage options, this guide dives deep into the essentials of business insurance bundles.

In the following sections, we will delve into the types of insurance coverage, customization options, and factors to consider when choosing the right bundle for your small firm.

Overview of Business Insurance Bundles

Business insurance bundles are packages that combine different types of insurance coverage into a single policy, tailored to meet the specific needs of small firms.

Benefits of Bundling Insurance Policies

- Cost Savings: Bundling insurance policies can result in discounted rates, saving small businesses money in the long run.

- Simplified Management: Having all insurance policies under one bundle makes it easier to manage and keep track of coverage.

- Customized Coverage: Business insurance bundles can be tailored to include specific types of coverage that are most relevant to the unique risks faced by a small firm.

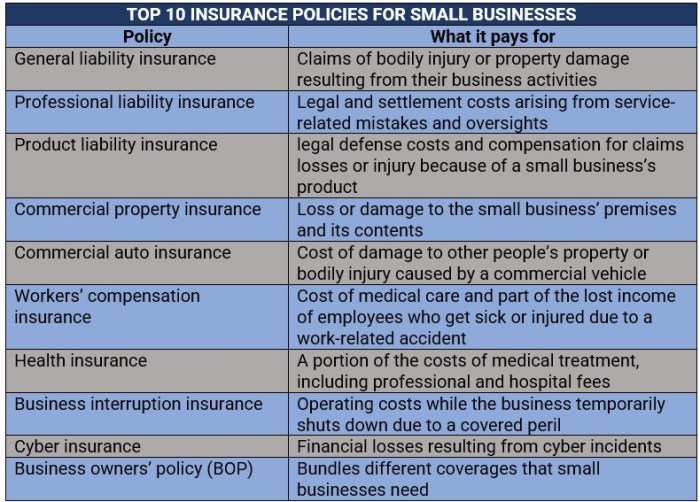

Common Types of Insurance Included

- General Liability Insurance: Protects against third-party claims of bodily injury, property damage, and personal injury.

- Property Insurance: Covers damage or loss of business property due to theft, fire, or other covered perils.

- Business Interruption Insurance: Provides financial support in case a business is unable to operate due to a covered event.

Cost Savings for Small Businesses

By bundling multiple insurance policies together, small firms can often secure a lower premium than if they were to purchase each policy separately. This cost-effective approach allows businesses to get comprehensive coverage at a more affordable price.

Types of Insurance Coverage in Business Bundles

When it comes to business insurance bundles, there are several key types of coverage that are typically included to provide comprehensive protection for small firms.

General Liability Insurance

General liability insurance is essential for small businesses as it provides coverage for third-party claims of bodily injury, property damage, and advertising injury. This type of insurance protects businesses from financial losses resulting from lawsuits or claims filed against them.

- General liability insurance covers legal fees, court costs, settlements, and judgments in the event of a covered claim.

- It also offers protection against claims of false advertising, slander, libel, and copyright infringement.

- Having general liability insurance can help small businesses maintain their reputation and financial stability in the face of unexpected legal challenges.

Property Insurance

Property insurance is crucial for small businesses to protect their physical assets, such as buildings, equipment, inventory, and furniture, from damage or loss due to covered perils like fire, theft, vandalism, or natural disasters.

- Property insurance helps small firms recover financially by covering the cost of repairing or replacing damaged or stolen assets.

- It also provides coverage for business interruption, helping to compensate for lost income and ongoing expenses during the recovery period.

- By having property insurance, small businesses can safeguard their operations and assets against unforeseen events that could otherwise lead to significant financial setbacks.

Worker’s Compensation Coverage

Worker’s compensation coverage is vital for small businesses to protect their employees in case of work-related injuries or illnesses. This type of insurance provides benefits to employees for medical expenses, lost wages, and rehabilitation costs resulting from on-the-job injuries.

- Worker’s compensation coverage helps small firms comply with state regulations and provide a safety net for employees who may suffer injuries while performing their job duties.

- It also protects small businesses from potential lawsuits by employees seeking compensation for workplace injuries, as it provides a no-fault system that prevents employees from suing their employer in exchange for receiving benefits.

- Having worker’s compensation coverage demonstrates a commitment to employee well-being and can improve morale and productivity in the workplace.

Customization Options for Small Firms

Small firms have the flexibility to customize their insurance bundles to meet their specific needs and provide tailored coverage for their unique risks. By adding additional coverage options to standard bundles and addressing industry-specific concerns, small businesses can ensure more comprehensive protection.

Examples of Additional Coverage Options

Small firms can enhance their insurance bundles by adding specialized coverage options such as:

- Business Interruption Insurance: Provides coverage for lost income and expenses if a business is forced to close temporarily due to a covered event.

- Cyber Liability Insurance: Protects against the financial losses associated with cyberattacks, data breaches, and other cyber threats.

- Professional Liability Insurance: Covers legal costs and damages related to claims of negligence or inadequate work performance.

Customizing Policies for Industry-Specific Risks

Small firms can work with insurance providers to tailor their policies to address risks specific to their industry. For example, a restaurant may need coverage for food spoilage, while a construction company may require protection against equipment damage. By customizing their insurance bundles, small businesses can ensure they are adequately protected against potential threats.

Benefits of Customizable Bundles

Customizable insurance bundles offer small firms the advantage of selecting coverage options that are most relevant to their operations. This targeted approach allows businesses to optimize their insurance policies and create a comprehensive risk management strategy. By tailoring their coverage, small firms can safeguard their assets, reputation, and financial stability in the face of unexpected events.

Factors to Consider When Choosing Business Insurance Bundles

When selecting business insurance bundles for small firms, there are several key factors to consider to ensure adequate coverage and cost-effectiveness. It is essential to compare bundled insurance options with individual policies, assess coverage limits, deductibles, and evaluate insurance providers carefully.

Cost-Effectiveness of Bundled Insurance vs. Individual Policies

- Business insurance bundles often offer cost savings compared to purchasing individual policies separately.

- Consider the total premium cost of bundled insurance versus the combined cost of individual policies to determine cost-effectiveness.

- Review the coverage levels and benefits included in each option to assess the value of bundled insurance for your specific business needs.

Assessing Coverage Limits and Deductibles in Insurance Bundles

- Examine the coverage limits provided in the insurance bundles to ensure they meet your business’s potential risks and liabilities.

- Consider the deductibles associated with each type of coverage in the bundle and evaluate how they align with your budget and risk tolerance.

- Adjust coverage limits and deductibles as needed to create a balanced insurance package that adequately protects your business without overpaying for unnecessary coverage.

Evaluating Insurance Providers Offering Business Insurance Bundles

- Research and compare insurance providers offering business insurance bundles to determine their reputation, financial stability, and customer service quality.

- Read reviews and testimonials from other small business owners who have purchased insurance bundles from the providers you are considering.

- Request quotes from multiple insurance providers and compare coverage options, pricing, and additional services offered to make an informed decision.

Ending Remarks

In conclusion, Top Business Insurance Bundles for Small Firms offer a lifeline of protection in an unpredictable business landscape. By understanding the intricacies of insurance coverage and customization, small businesses can secure their future with confidence.

Q&A

What are the benefits of bundling insurance policies for small firms?

Bundling insurance policies can lead to cost savings, simplified management, and more comprehensive coverage for small businesses.

How can small firms customize their insurance bundles?

Small firms can customize their bundles by adding specific coverage options tailored to their industry and business needs.

What factors should small firms consider when choosing business insurance bundles?

Small firms should consider cost-effectiveness, coverage limits, deductibles, and the reputation of insurance providers when selecting bundles.